BillEase

Shared Financial Management for Students and Families

Overview

CloverBank, a forward-thinking neobank, sought an innovative solution to serve non-customers in Canada by addressing a critical financial need. With no physical branches and a direction to create a single-function app, the goal was to solve a pressing financial challenge—to attract new customers to the platform—while delivering a user-centered product.

Our team took on the challenge, focusing on simplifying shared financial management for users like Carmella Hernandez, a 21-year-old international student balancing academics, work, and family support.

Problem Statement

Managing shared financial responsibilities is often a source of stress, especially for students like Carmella, who rely on family support while striving for independence. Carmella juggles two part-time jobs and her studies while coordinating with her parents to cover essential expenses like rent and bills. This process involves constant communication, repetitive money transfers, and unclear accountability—challenges that are amplified by a lack of effective tools for collaboration. CloverBank recognized this gap and tasked our team with creating a solution that fosters trust, transparency, and independence for users.

Understanding the Users

Meet Carmella

Our primary persona was Carmella Hernandez, a 21-year-old international student from Mexico studying biochemistry in Montreal. Carmella works two part-time jobs—as a teaching assistant and at her university’s reception desk—while her parents assist with her tuition and living expenses.

Despite their close relationship, managing shared financial responsibilities was stressful, requiring constant communication and manual coordination for payments. Carmella’s story highlighted the challenges of transitioning to financial independence while maintaining trust and transparency with her parents.

The Journey to a Solution

Mapping the Problem

We began by building a journey map of Carmella’s financial experience, identifying key pain points:

Unclear Communication: Difficulty tracking who had paid what and when.

Repetitive Transfers: Tedious requests for money to cover recurring bills.

Limited Financial Tools: A lack of shared options to manage bills collaboratively.

→

→

→

From these key pain points, we identified Jobs to Be Done (JTBD) to better understand user needs:

Design a system that clearly tracks shared bill payments so that users always know who has paid and what is still outstanding.

Provide flexible payment options that reduce the need for repeated money transfers and manual coordination between users.

Develop a collaborative bill management system that allows users to split, contribute, and manage expenses without unnecessary friction.

These insights led us to develop How Might We (HMW) questions to guide our ideation:

HMW simplify communication around shared financial responsibilities so that users can easily coordinate payments without back-and-forth messaging?

HMW enable better tracking and transparency for payments so that users always know who has paid and what is still owed?

HMW provide flexibility in managing shared expenses so that users can contribute in a way that fits their financial situation?

Diverging Ideas: Three Concepts

Each team member developed a distinct design concept to address these questions:

Monitor and Remind (Concept 1): Focused on tracking payments, sending reminders, and enabling parents to monitor expenses.

Bill Attachments (Concept 2): Allowed users to attach bills, enabling parents to pay them directly.

Shared Wallet (Concept 3): A multi-currency wallet for pooling funds, simplifying payments for shared bills.

Concept 1

Concept 2

Concept 3

After presenting these concepts to the client, we received useful feedback that encouraged us to merge the best features into a unified solution.

Iterating Toward the Freedom Ladder

Inspired by the feedback, we embraced the concept of a "freedom ladder," where users could gradually transition from shared financial management to full independence. We refined the design to include:

Automatic Notifications: Users could see who had been notified, with notifications sent automatically.

Revisited Homepage: Simplified navigation with clearer colors and sorting features.

Pop-Up Notifications: To guide users through critical actions.

Comparison Feature: Allowed users to evaluate bills against spending habits.

Privacy Settings: Customizable options to protect sensitive data.

Bringing the Vision to Life: High-Fidelity Prototypes

We developed the first high-fidelity prototype and conducted three rounds of usability testing, each lasting 20 minutes. Initial feedback revealed areas for improvement:

Users wanted more granular privacy settings for shared bills.

There was a preference for partial bill payments rather than paying the full amount.

The reminder/calendar icon needed clearer functionality.

After implementing these changes, we conducted a second round of testing, which showed significant improvements:

Users appreciated multiple exit points before payment.

Clearer bill breakdowns enhanced transparency.

Participants praised the app’s simplicity, quick navigation, and dashboard features.

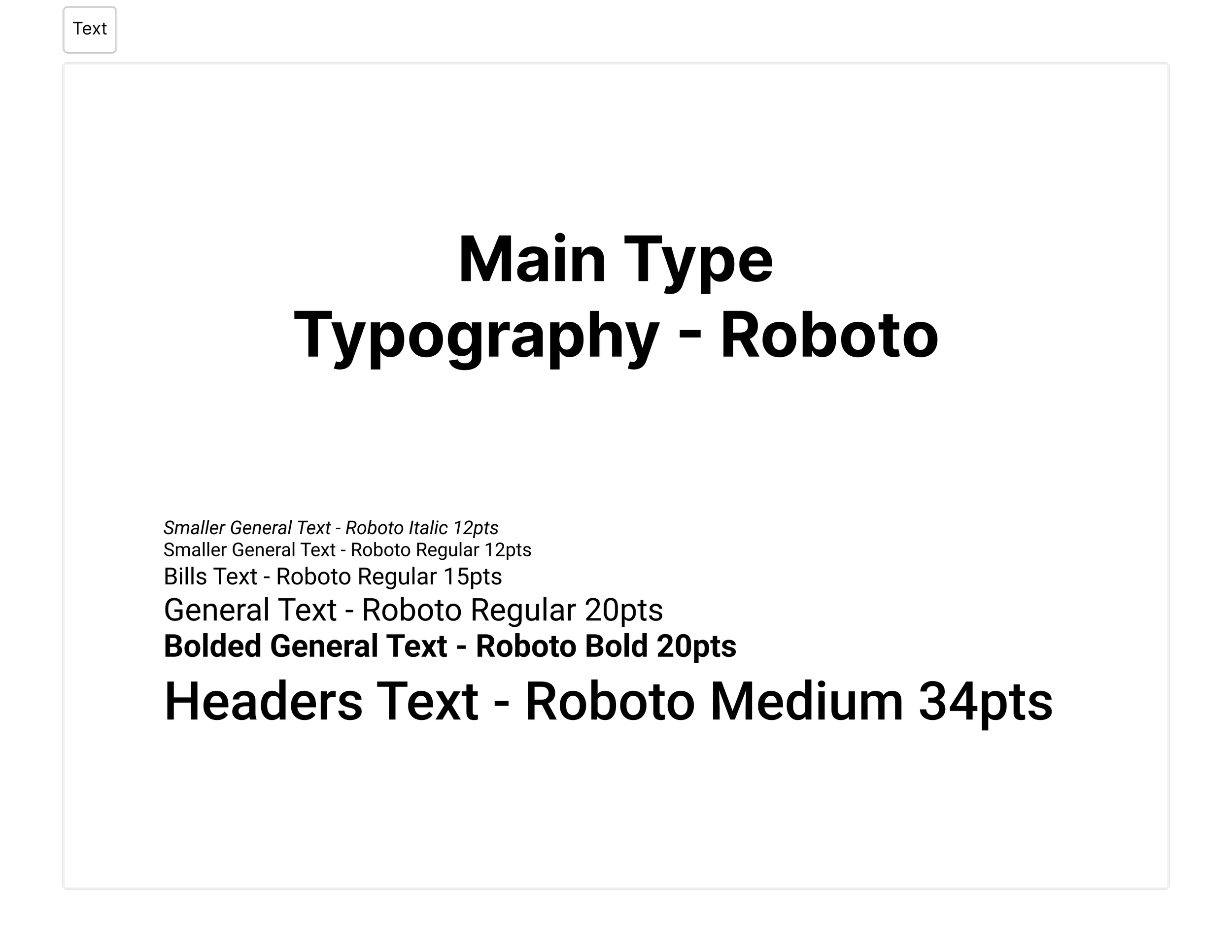

Components

The Final Solution: BillEase

The final design of BillEase integrated the best features from our concepts and user feedback, creating a seamless experience for shared financial management. Key features included:

Shared Wallet: Simplified pooling of funds with multi-currency support.

Enhanced Notifications: Automatic updates with visibility into actions taken.

Privacy Controls: Customizable settings for user confidence and security.

Dashboard Navigation: Quick and intuitive access to bills and payment options.

Prototype

Outcomes and Impact

The final prototype was well-received by both users and the client. Testing showed:

A 25% reduction in time spent managing shared bills.

Increased user satisfaction, with participants describing the app as "intuitive" and "empowering."

Improved task success rates, with users completing bill-related tasks effortlessly.

BillEase not only addressed the client’s goals but also delivered a user-centered solution that fosters trust, transparency, and independence for students and families.

Lessons Learned

Collaboration Yields Results: Leveraging team strengths and merging ideas created a more robust solution.

User Feedback Drives Improvement: Iterative testing ensured the app addressed real-world pain points effectively.

Empathy Is Key: Understanding Carmella’s journey informed every design decision, resulting in a more impactful product.

Recommendations

Expand Privacy Features: Offer even more granular controls for shared financial tools.

Integrate Analytics: Provide spending insights to help users make informed decisions.

Enhance Onboarding: Simplify registration and introduce tutorials for first-time users.